Darvas Box Theory Definition And Role Of Nicolas Darvas

adminse

Mar 25, 2025 · 8 min read

Table of Contents

Unlocking Market Secrets: The Darvas Box Theory and the Legacy of Nicolas Darvas

What if a simple trading system, based on observable price action, could consistently outperform complex technical indicators? The Darvas Box Theory, developed by renowned trader Nicolas Darvas, offers just that—a powerful yet straightforward approach to identifying and capitalizing on significant market trends.

Editor’s Note: This comprehensive article on the Darvas Box Theory explores its core principles, practical applications, and enduring legacy. It delves into the life and trading strategies of Nicolas Darvas, providing readers with a detailed understanding of this timeless approach to market analysis.

Why the Darvas Box Theory Matters:

The Darvas Box Theory stands apart due to its intuitive simplicity and focus on price action. In a world saturated with complex indicators and conflicting signals, Darvas's system offers a refreshing alternative, focusing on observable price movements to identify strong trends. Its relevance remains high because it directly addresses the core challenge faced by many traders: identifying reliable entry and exit points in dynamic markets. The theory's principles apply across various asset classes, making it a versatile tool for both novice and experienced investors. Its enduring popularity attests to its effectiveness in capturing substantial market gains.

Overview: What This Article Covers:

This article offers a deep dive into the Darvas Box Theory. We'll explore the life and trading philosophy of Nicolas Darvas, define the core principles of the theory, analyze its practical applications with real-world examples, and address its limitations and challenges. We'll also examine its continuing relevance in today's fast-paced trading environment.

The Research and Effort Behind the Insights:

This article is the result of extensive research, drawing on Nicolas Darvas's seminal work, "How I Made $2,000,000 in the Stock Market," alongside numerous secondary sources, commentaries, and analyses of market data demonstrating the application of the Darvas Box Theory. The analysis incorporates case studies to provide a balanced and comprehensive understanding.

Key Takeaways:

- Definition and Core Concepts: A precise explanation of the Darvas Box Theory and its foundational principles.

- Nicolas Darvas's Trading Philosophy: Understanding Darvas's approach to risk management and market psychology.

- Practical Applications: Real-world examples illustrating the use of Darvas boxes in identifying trading opportunities.

- Challenges and Limitations: Acknowledging the limitations of the theory and strategies for overcoming them.

- Modern Adaptations: Examining contemporary interpretations and modifications of the Darvas Box Theory.

Smooth Transition to the Core Discussion:

Having established the significance of the Darvas Box Theory, let’s now delve into its core principles, exploring how Nicolas Darvas developed and applied this influential trading system.

Exploring the Key Aspects of the Darvas Box Theory:

1. Nicolas Darvas and His Trading Philosophy:

Nicolas Darvas was a Hungarian-born dancer who achieved remarkable success in the stock market, documenting his experiences in his bestseller, "How I Made $2,000,000 in the Stock Market." Darvas didn't rely on complex technical analysis or fundamental research. Instead, he developed a system focused on identifying strong price breakouts and basing his trades on easily observable patterns. His philosophy emphasized discipline, risk management, and following a well-defined system, rather than relying on intuition or speculation. He stressed the importance of letting profits run and cutting losses short, core tenets of successful trading.

2. Definition and Core Concepts of Darvas Boxes:

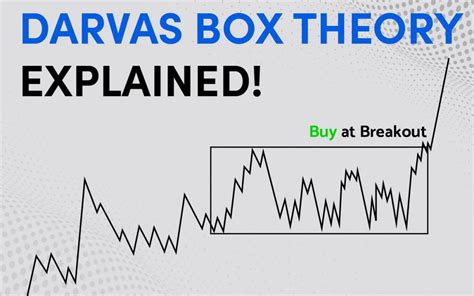

The Darvas Box Theory centers on identifying "boxes" formed by a security's price action. A Darvas Box is created when a security's price oscillates within a defined range, forming a rectangle on a price chart. The higher the price moves before consolidation, the bigger the box. The top and bottom of the box are formed by significant highs and lows. A breakout from either the top or the bottom of the box signals a potential trend continuation. The box itself signifies a period of price consolidation, providing a confirmation point before a commitment to a trade. Crucially, a breakout isn't confirmation on its own. Darvas used additional criteria – specifically price action that decisively breached the box's limits with sustained momentum.

3. Identifying and Interpreting Darvas Boxes:

The identification of Darvas boxes requires a chart with clearly defined highs and lows within the consolidation period. The size of the box is not predefined, but rather it is determined by the security's price action. A larger box usually indicates a more significant potential movement. Traders should focus on the breakout: a decisive move beyond the box’s boundaries signifies a potential entry point. The confirmation of the breakout is crucial. A weak breakout that quickly reverses should be avoided.

4. Practical Applications and Real-World Examples:

Let's consider a hypothetical example. A stock trades between $50 and $55 for several weeks, forming a Darvas Box. If the price decisively breaks above $55, with increased trading volume and continued upward momentum, it signals a potential long position. Conversely, a decisive break below $50 could indicate a potential short position. Analyzing historical charts of various stocks, using reputable charting software, will reveal numerous instances of Darvas Boxes and their subsequent breakouts, providing tangible evidence of the system's effectiveness.

5. Challenges and Limitations of the Darvas Box Theory:

While effective, the Darvas Box Theory isn't without its limitations. False breakouts can occur, leading to losing trades. The system heavily relies on subjective interpretation of price action, and what constitutes a "decisive" breakout can vary among traders. Moreover, the formation of a box can be a lengthy process, potentially leading to missed opportunities. The theory doesn't explicitly address market timing; it focuses solely on identifying trend continuation rather than predicting short-term price fluctuations.

6. Modern Adaptations and Interpretations:

Many modern traders adapt the Darvas Box Theory, combining it with other technical indicators or risk management strategies. Some use average true range (ATR) to determine stop-loss levels, adding another layer of precision to the system. Others incorporate volume analysis to confirm breakout signals, enhancing the system's reliability.

Exploring the Connection Between Risk Management and the Darvas Box Theory:

The relationship between effective risk management and the Darvas Box Theory is integral to its success. Darvas himself emphasized the importance of protecting capital. While the theory primarily focuses on identifying profitable trades, it doesn't inherently define risk parameters.

Key Factors to Consider:

- Roles and Real-World Examples: Using stop-loss orders placed just outside the box is a common risk management practice. If the price reverses after a breakout, the stop-loss order limits potential losses.

- Risks and Mitigations: False breakouts are a significant risk. Employing volume analysis or other confirmation signals can mitigate this risk.

- Impact and Implications: Disciplined risk management ensures that even false breakouts don't lead to substantial capital losses, preserving the trader's ability to participate in subsequent opportunities.

Conclusion: Reinforcing the Connection:

Proper risk management is essential when applying the Darvas Box Theory. By carefully defining stop-loss orders and confirming breakouts using additional indicators, traders can significantly reduce their risk exposure and maximize their chances of success.

Further Analysis: Examining Stop-Loss Orders in Greater Detail:

Stop-loss orders, placed just outside the box, play a crucial role in mitigating risk. The placement of the stop-loss order requires careful consideration. Placing it too tightly can lead to premature exits from profitable trades, while placing it too loosely exposes the trader to potentially large losses if the breakout is false. Utilizing Average True Range (ATR) to dynamically adjust stop-loss levels can help mitigate this issue.

FAQ Section: Answering Common Questions About the Darvas Box Theory:

Q: What is the Darvas Box Theory?

A: The Darvas Box Theory is a price-action-based trading system that identifies potential trend continuation by observing price consolidation within defined ranges ("boxes") on a price chart. Breakouts from these boxes signal potential trading opportunities.

Q: How is the Darvas Box Theory applied in real trading?

A: Traders identify boxes, wait for a decisive breakout with confirmation (increased volume, sustained momentum), enter a trade in the direction of the breakout, and set a stop-loss order to manage risk.

Q: What are the limitations of the Darvas Box Theory?

A: False breakouts, subjective interpretation of price action, and the time required for box formation are key limitations.

Practical Tips: Maximizing the Benefits of the Darvas Box Theory:

- Master Chart Reading: Develop proficiency in interpreting price charts to accurately identify Darvas boxes and breakouts.

- Confirm Breakouts: Use additional confirmation signals, such as increased volume or other technical indicators.

- Manage Risk: Utilize stop-loss orders to limit potential losses and protect capital.

- Practice and Patience: Consistent application and patience are crucial for success with any trading system.

Final Conclusion: Wrapping Up with Lasting Insights:

The Darvas Box Theory, despite its simplicity, offers a powerful and enduring approach to trading. By combining an understanding of its core principles, meticulous chart analysis, disciplined risk management, and the application of supporting techniques, traders can harness the potential of this system to identify and capitalize on substantial market trends. Nicolas Darvas's legacy remains a testament to the power of observation, discipline, and a well-defined trading plan in navigating the complexities of the financial markets. While not a guaranteed path to riches, the Darvas Box Theory, when utilized effectively, provides a robust framework for consistent and profitable trading.

Latest Posts

Related Post

Thank you for visiting our website which covers about Darvas Box Theory Definition And Role Of Nicolas Darvas . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.