Current Yield Definition Formula And How To Calculate It

adminse

Mar 25, 2025 · 8 min read

Table of Contents

Understanding Current Yield: Definition, Formula, and Calculation

What if understanding current yield unlocks a deeper understanding of your investment portfolio's performance? This fundamental financial metric offers crucial insights into the return on fixed-income investments.

Editor’s Note: This article on current yield definition, formula, and calculation was published today, providing readers with up-to-date information and practical guidance on this essential financial concept.

Why Current Yield Matters: Relevance, Practical Applications, and Industry Significance

Current yield is a crucial metric for investors seeking to understand the return on their fixed-income investments, such as bonds and preferred stocks. It provides a snapshot of the annual income generated relative to the current market price, unlike yield to maturity (YTM) which considers the bond's price at maturity. This allows for a quick comparison of different fixed-income securities, regardless of their maturity dates or face values. Understanding current yield is vital for making informed investment decisions, portfolio diversification, and risk management. It’s a core component of financial analysis used by individual investors, financial institutions, and portfolio managers alike.

Overview: What This Article Covers

This article provides a comprehensive guide to current yield, covering its definition, the formula for its calculation, step-by-step examples, and practical applications. We'll explore how current yield differs from other yield measures, the factors that influence it, and its limitations. The article also addresses frequently asked questions and provides actionable tips for utilizing current yield effectively in investment strategies.

The Research and Effort Behind the Insights

This article draws upon widely accepted financial principles, standard investment textbooks, and reputable online financial resources. The explanations and examples are designed to be clear, concise, and accessible to a broad audience, regardless of their prior financial knowledge. The information presented is intended to be accurate and up-to-date but should not be considered financial advice.

Key Takeaways:

- Definition and Core Concepts: A clear explanation of current yield and its foundational principles.

- Formula and Calculation: A step-by-step guide to calculating current yield with practical examples.

- Applications and Interpretations: How to use current yield to compare investments and make informed decisions.

- Limitations and Considerations: Understanding the boundaries of current yield and its limitations.

- Comparison with other Yield Measures: Differentiating current yield from yield to maturity (YTM) and other yield calculations.

Smooth Transition to the Core Discussion:

With a firm understanding of the importance of current yield, let's delve into its core components – the definition and the formula that underpins its calculation.

Exploring the Key Aspects of Current Yield

1. Definition and Core Concepts:

Current yield represents the annual income generated by an investment relative to its current market price. It's expressed as a percentage and provides a simple measure of the return an investor can expect based on the current market value of the security. This differs significantly from yield to maturity (YTM), which accounts for the time value of money and the bond's face value at maturity. Current yield focuses solely on the current income stream relative to the current price.

2. Formula and Calculation:

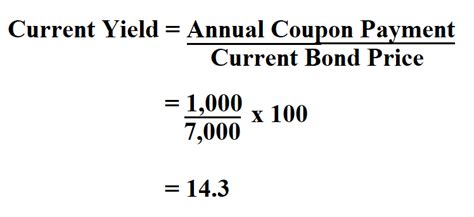

The formula for calculating current yield is straightforward:

Current Yield = (Annual Interest Payment / Current Market Price) x 100

Where:

- Annual Interest Payment: This is the total amount of interest paid annually by the investment. For bonds, this is the coupon payment. For preferred stocks, it's the annual dividend.

- Current Market Price: This is the current trading price of the investment in the market.

Example 1: Bond

Let's say a bond has a face value of $1,000, a coupon rate of 5%, and pays interest semi-annually. The annual interest payment would be $50 ($1,000 x 0.05). If the current market price of the bond is $950, the current yield is calculated as follows:

Current Yield = ($50 / $950) x 100 = 5.26%

Example 2: Preferred Stock

A preferred stock pays an annual dividend of $4 per share. If the current market price of the preferred stock is $80 per share, the current yield is:

Current Yield = ($4 / $80) x 100 = 5%

3. Applications and Interpretations:

Current yield is primarily used for comparison purposes. Investors can compare the current yield of different fixed-income securities to determine which offers the highest return based on the current market price. A higher current yield suggests a potentially greater return for the current investment, but this should be considered in conjunction with other factors like risk and maturity date.

4. Limitations and Considerations:

While current yield is a valuable metric, it has limitations. It doesn't account for the time value of money or the eventual repayment of principal at maturity. Therefore, it's not a complete picture of the investment's total return. For long-term investments, yield to maturity (YTM) is a more comprehensive measure. Furthermore, current yield is highly sensitive to changes in market prices. If the market price fluctuates, the current yield will change accordingly, even if the annual interest payment remains constant.

5. Comparison with Other Yield Measures:

-

Yield to Maturity (YTM): YTM considers the total return from an investment, including the annual interest payments and the eventual repayment of principal at maturity. It's discounted to account for the time value of money, providing a more comprehensive picture of the investment's total return.

-

Yield to Call (YTC): If a bond has a call provision (allowing the issuer to redeem it before maturity), YTC calculates the return if the bond is called at its call price.

-

Running Yield: Similar to current yield, but often used for bonds that pay interest more frequently than annually.

Exploring the Connection Between Market Price and Current Yield

The relationship between market price and current yield is inversely proportional. As the market price of a fixed-income security increases, its current yield decreases, and vice-versa. This is because the annual interest payment remains constant; therefore, a higher price leads to a lower yield. This relationship is crucial for investors to understand when evaluating investment opportunities and assessing potential risks.

Key Factors to Consider:

-

Roles and Real-World Examples: Consider a scenario where interest rates rise. The market price of existing bonds will likely fall, leading to a higher current yield. Conversely, if interest rates fall, bond prices rise, leading to a lower current yield. This makes current yield a useful indicator of market sentiment towards interest rate movements.

-

Risks and Mitigations: The primary risk associated with relying solely on current yield is the failure to account for capital gains or losses. A high current yield might be offset by a significant price decline before maturity. Diversification and careful consideration of other yield metrics can mitigate this risk.

-

Impact and Implications: The impact of changes in current yield can significantly affect investor decisions. A sudden increase in current yield might attract investors seeking higher returns, potentially driving up demand and stabilizing or increasing the price of the security. Conversely, a sharp decrease might signal a shift in market sentiment, potentially causing price declines.

Conclusion: Reinforcing the Connection

The interplay between market price and current yield highlights the dynamic nature of fixed-income investing. While current yield offers a convenient measure of current return, it’s crucial to consider the broader context, including the overall market environment, the specific characteristics of the investment, and other yield metrics.

Further Analysis: Examining Market Interest Rates in Greater Detail

Market interest rates are a critical external factor that significantly influences current yield. When market interest rates rise, the current yield of existing bonds generally increases because their fixed coupon payments become more attractive relative to newly issued bonds offering higher yields. Conversely, when market interest rates fall, the current yield of existing bonds generally decreases. Understanding the relationship between market interest rates and current yield is vital for making informed investment decisions.

FAQ Section: Answering Common Questions About Current Yield

Q: What is the difference between current yield and yield to maturity (YTM)?

A: Current yield focuses solely on the annual income relative to the current market price. YTM considers the total return, including principal repayment at maturity and accounts for the time value of money, providing a more comprehensive measure of return over the investment's life.

Q: How is current yield used in investment decision-making?

A: Current yield helps compare the attractiveness of different fixed-income securities based on their current market prices. Higher current yields, all else equal, suggest a potentially greater return relative to the current investment. However, other factors such as risk, maturity, and credit quality must also be considered.

Q: Can current yield be negative?

A: No, current yield cannot be negative. A negative current yield would imply that the annual interest payment is less than zero which is not possible. However, the change in current yield can be negative, reflecting a decrease in the current yield over time.

Practical Tips: Maximizing the Benefits of Understanding Current Yield

- Understand the Basics: Begin by thoroughly grasping the definition and formula for calculating current yield.

- Compare Investments: Use current yield to compare similar fixed-income securities to identify those offering potentially higher returns relative to their current prices.

- Consider Other Metrics: Don't rely solely on current yield. Incorporate other yield metrics like YTM and factors such as credit risk and maturity date into your investment analysis.

- Monitor Market Conditions: Keep abreast of changes in market interest rates, as these directly impact current yields.

- Diversify your Portfolio: Spread your investments across different asset classes and maturities to reduce risk.

Final Conclusion: Wrapping Up with Lasting Insights

Current yield serves as a valuable tool for assessing the current return offered by fixed-income investments. However, its limitations emphasize the importance of considering it alongside other relevant metrics and factors. By understanding current yield's calculation, applications, and limitations, investors can enhance their investment decision-making process and improve their portfolio management strategies. Ultimately, a well-rounded understanding of current yield contributes to more informed and successful investment outcomes.

Latest Posts

Related Post

Thank you for visiting our website which covers about Current Yield Definition Formula And How To Calculate It . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.