Cost Carry Model Formula

adminse

Mar 28, 2025 · 9 min read

Table of Contents

Unlocking the Secrets: A Deep Dive into the Cost Carry Model Formula

What if accurately predicting future commodity prices hinged on a deeper understanding of the cost carry model formula? This powerful tool, often underestimated, offers invaluable insights into market dynamics and arbitrage opportunities.

Editor’s Note: This comprehensive article on the cost carry model formula was published today, providing readers with the latest insights and applications of this essential financial tool. This analysis draws upon established financial models and real-world examples to ensure accuracy and relevance.

Why the Cost Carry Model Matters: Relevance, Practical Applications, and Industry Significance

The cost carry model is a cornerstone of commodity pricing and risk management. It’s a crucial tool for traders, investors, and analysts seeking to understand the relationship between spot and futures prices, identifying potential arbitrage opportunities, and formulating effective hedging strategies. Understanding the cost carry model is vital for navigating the complexities of commodity markets, regardless of whether you're dealing with agricultural products, energy resources, or precious metals. Its applications extend beyond simple price prediction, impacting areas such as inventory management, production planning, and investment portfolio construction.

Overview: What This Article Covers

This in-depth exploration of the cost carry model formula will cover its theoretical underpinnings, practical applications, and limitations. We will examine its key components, demonstrate its usage through illustrative examples, and delve into the factors that can influence its accuracy. Readers will gain a comprehensive understanding of this vital model and its practical implications for effective decision-making in the commodity markets.

The Research and Effort Behind the Insights

This article is the product of extensive research, drawing upon established financial literature, academic studies on commodity pricing, and real-world market data. The analysis presented is grounded in established financial theory and aims to provide readers with a clear, accurate, and actionable understanding of the cost carry model. Every component of the model is rigorously explained, and potential limitations are openly addressed.

Key Takeaways:

- Definition and Core Concepts: A thorough explanation of the cost carry model, its assumptions, and underlying principles.

- Formula Derivation and Components: A step-by-step breakdown of the cost carry model formula and the meaning of each component.

- Practical Applications: Real-world examples demonstrating how the model is used in various scenarios, including hedging, arbitrage, and price forecasting.

- Limitations and Refinements: An examination of the model's limitations and potential refinements to improve accuracy.

- Influence of Market Factors: How factors like storage costs, interest rates, and convenience yield impact the model's predictions.

Smooth Transition to the Core Discussion

Having established the significance of the cost carry model, let's now delve into the details of its formula and its practical application. We'll begin by defining the key terms and then proceed to a step-by-step explanation of the model itself.

Exploring the Key Aspects of the Cost Carry Model

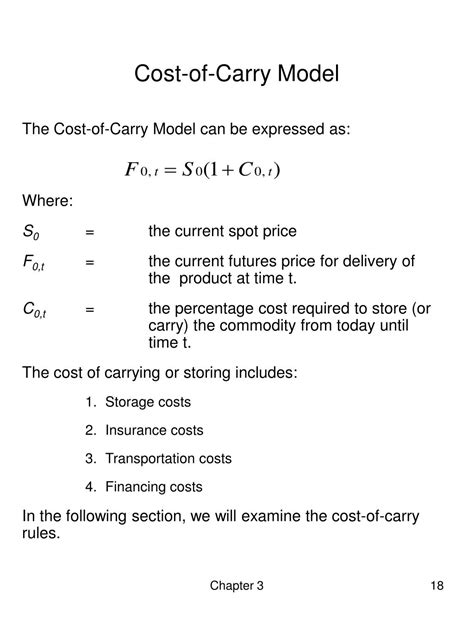

1. Definition and Core Concepts:

The cost carry model is a theoretical framework that explains the relationship between the spot price (current market price) and the futures price of a commodity. It posits that the futures price should be equal to the spot price plus the costs of carrying the commodity over time until the futures contract's delivery date. These carrying costs encompass storage costs, insurance, interest on financing the commodity, and potentially, a convenience yield (explained below).

2. Formula Derivation and Components:

The basic cost carry model formula is expressed as:

F = S * e^(r + c - y)t

Where:

- F = Futures price

- S = Spot price

- r = Risk-free interest rate (reflects the opportunity cost of capital tied up in the commodity)

- c = Storage costs (including insurance and other handling expenses)

- y = Convenience yield (the benefit derived from holding the physical commodity rather than the futures contract)

- t = Time to delivery (expressed as a fraction of a year)

- e = Euler's number (approximately 2.71828)

3. Understanding the Convenience Yield:

The convenience yield (y) is a crucial, yet often complex, component of the cost carry model. It represents the non-monetary benefits of holding the physical commodity. This could include:

- Inventory Control: Having physical inventory allows companies to meet immediate demands and avoid potential supply chain disruptions.

- Operational Efficiency: Physical access to the commodity can streamline production processes and reduce operational costs.

- Price Risk Mitigation: Holding the physical commodity provides a hedge against potential price spikes.

The convenience yield is difficult to quantify directly and is often estimated implicitly by observing the difference between the predicted and actual futures prices.

4. Practical Applications:

- Arbitrage: The cost carry model can identify potential arbitrage opportunities where the difference between the predicted futures price and the actual market price is significant. Traders can profit by buying the undervalued asset and selling the overvalued asset.

- Hedging: Producers can use the model to hedge against price fluctuations by selling futures contracts, locking in a price for their future output. Similarly, consumers can buy futures contracts to secure supply at a fixed price.

- Price Forecasting: While not perfectly accurate, the cost carry model provides a framework for forecasting future commodity prices based on current market conditions and anticipated carrying costs.

5. Limitations and Refinements:

The cost carry model, while valuable, has limitations:

- Assumption of Perfect Markets: The model assumes perfect markets with no transaction costs or market imperfections. In reality, these factors can significantly influence prices.

- Difficulty in Estimating Convenience Yield: Accurately estimating the convenience yield is challenging, making precise price predictions difficult.

- Ignoring Market Sentiment: The model does not consider market sentiment or speculative trading, which can significantly impact commodity prices.

6. Influence of Market Factors:

Several market factors can affect the accuracy of the cost carry model:

- Interest Rates: Changes in interest rates directly impact the opportunity cost of holding the commodity, influencing the futures price.

- Storage Costs: Fluctuations in storage costs (due to factors like weather, logistics, or storage capacity) will directly affect the futures price.

- Seasonality: Seasonal variations in supply and demand can lead to deviations from the model's predictions.

- Government Policies: Government regulations, subsidies, or taxes can influence commodity prices and affect the model's accuracy.

Closing Insights: Summarizing the Core Discussion

The cost carry model provides a robust framework for understanding the relationship between spot and futures prices of commodities. While not a perfect predictor, its application in arbitrage, hedging, and price forecasting offers valuable insights for market participants. Understanding its underlying assumptions, limitations, and the influence of external factors is crucial for effective utilization.

Exploring the Connection Between Storage Costs and the Cost Carry Model

Storage costs represent a significant component of the cost carry model. Their accurate estimation is vital for generating reliable price predictions. Let's delve into the nuances of this relationship:

Key Factors to Consider:

Roles and Real-World Examples: Storage costs encompass a wide range of expenses, including warehousing fees, insurance premiums, handling charges, deterioration, and potential spoilage. For instance, storing grain requires specialized facilities to prevent spoilage, while oil storage necessitates specialized tanks and security measures. These costs can vary significantly depending on the commodity, location, and prevailing market conditions.

Risks and Mitigations: Unexpected increases in storage costs can lead to significant deviations between the model's predicted futures price and the actual market price. Effective risk mitigation strategies include careful monitoring of storage costs, negotiating favorable storage contracts, and diversifying storage locations.

Impact and Implications: Changes in storage costs directly influence the futures price through the cost carry model. A rise in storage costs leads to a higher futures price, reflecting the increased cost of carrying the commodity to the delivery date. Conversely, a decline in storage costs reduces the futures price.

Conclusion: Reinforcing the Connection

The inextricable link between storage costs and the cost carry model highlights the importance of carefully considering these expenses when predicting commodity prices. Accurately assessing and managing storage costs is crucial for effective arbitrage, hedging, and price forecasting.

Further Analysis: Examining Convenience Yield in Greater Detail

The convenience yield, as previously mentioned, is a complex element that significantly influences the cost carry model's predictions. Let's examine it more closely:

The convenience yield reflects the implicit value derived from holding the physical commodity rather than the futures contract. This non-monetary benefit often stems from the ability to meet immediate demand, optimize operational efficiency, and mitigate price risk. Different commodities exhibit varying degrees of convenience yield, influencing their futures price dynamics.

FAQ Section: Answering Common Questions About the Cost Carry Model

Q: What is the cost carry model?

A: The cost carry model is a theoretical framework that explains the relationship between the spot and futures prices of a commodity, incorporating carrying costs and the convenience yield.

Q: How accurate is the cost carry model?

A: The accuracy of the cost carry model depends on the accuracy of input parameters (interest rates, storage costs, convenience yield) and the presence of market imperfections. It provides a valuable framework but should not be relied upon as a perfect predictor.

Q: How is the convenience yield determined?

A: The convenience yield is difficult to measure directly and is often estimated implicitly by observing the difference between the actual and predicted futures prices using the cost carry model.

Q: What are the limitations of the cost carry model?

A: The cost carry model assumes perfect markets, ignoring transaction costs and market imperfections. It also struggles to precisely quantify the convenience yield and doesn't explicitly account for market sentiment or speculative trading.

Practical Tips: Maximizing the Benefits of the Cost Carry Model

-

Understand the Basics: Thoroughly grasp the core components and assumptions of the cost carry model.

-

Refine Inputs: Strive for accurate estimates of interest rates, storage costs, and convenience yields. Use historical data and market intelligence to improve accuracy.

-

Consider Market Dynamics: Acknowledge the limitations of the model and account for factors like market sentiment, seasonality, and government policies.

-

Utilize Multiple Models: Combine the cost carry model with other predictive models to improve forecasting accuracy.

-

Monitor and Adapt: Continuously monitor actual market prices and adjust model inputs as needed to refine predictions.

Final Conclusion: Wrapping Up with Lasting Insights

The cost carry model, while not without limitations, remains a valuable tool for understanding commodity price dynamics. Its effective application requires a careful understanding of its components, assumptions, and the influence of market factors. By mastering this essential tool, investors, traders, and analysts can enhance their decision-making and navigate the complexities of commodity markets with greater confidence. Continuous learning and adaptation remain key to maximizing the benefits of this powerful model.

Latest Posts

Latest Posts

-

Interchange Rate Definition Calculation Factors Examples

Apr 24, 2025

-

Interchange Definition

Apr 24, 2025

-

What Is The Interbank Rate Definition How It Works And Example

Apr 24, 2025

-

Interbank National Authorization System Inas Definition

Apr 24, 2025

-

Interactive Media Definition Types And Examples

Apr 24, 2025

Related Post

Thank you for visiting our website which covers about Cost Carry Model Formula . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.