Consumer Reporting Agency Definition

adminse

Mar 25, 2025 · 9 min read

Table of Contents

Decoding Consumer Reporting Agencies: A Comprehensive Guide

What if the future of financial access hinges on a clear understanding of consumer reporting agencies? These powerful entities shape credit decisions, impacting individuals' financial lives in profound ways.

Editor’s Note: This article on consumer reporting agencies (CRAs) was published today, providing readers with up-to-date information on their functions, impact, and the importance of understanding your rights.

Why Consumer Reporting Agencies Matter:

Consumer reporting agencies, often referred to as credit bureaus, play a pivotal role in the modern financial system. They collect, analyze, and disseminate information about individuals' creditworthiness, impacting access to loans, credit cards, insurance, employment opportunities, and even rental housing. Understanding how CRAs operate is crucial for consumers to protect their financial well-being and navigate the complexities of the credit system. The impact of inaccurate or incomplete information in your credit report can significantly hinder your financial prospects, underscoring the importance of understanding your rights and responsibilities. The Fair Credit Reporting Act (FCRA) exists to protect consumers from inaccuracies and misuse of their credit information, emphasizing the need for consumer awareness and engagement.

Overview: What This Article Covers:

This article delves into the core aspects of consumer reporting agencies, exploring their definition, functions, the data they collect, the legal framework governing their operations, the rights of consumers, and strategies for maintaining a healthy credit profile. Readers will gain actionable insights, backed by data-driven research and expert analysis, empowering them to effectively manage their credit information.

The Research and Effort Behind the Insights:

This article is the result of extensive research, incorporating insights from legal experts, consumer advocacy groups, industry reports, and the Fair Credit Reporting Act (FCRA) itself. Every claim is supported by evidence, ensuring readers receive accurate and trustworthy information. The information presented aims to provide a comprehensive overview of CRAs, emphasizing both their positive contributions to the financial system and the potential pitfalls consumers should be aware of.

Key Takeaways:

- Definition and Core Concepts: A clear understanding of what constitutes a CRA and its fundamental role in the credit system.

- Data Collection and Reporting: An examination of the types of information CRAs collect and how this information is used to generate credit reports.

- Legal Framework (FCRA): A detailed exploration of the Fair Credit Reporting Act and its provisions for consumer protection.

- Consumer Rights and Responsibilities: A comprehensive overview of consumer rights under the FCRA and the steps consumers can take to protect their credit information.

- Dispute Resolution and Accuracy: Guidance on resolving inaccuracies and disputing information in credit reports.

- Impact on Financial Decisions: An analysis of how credit reports influence various financial decisions, including loan applications and insurance premiums.

Smooth Transition to the Core Discussion:

With a clear understanding of why consumer reporting agencies matter, let’s dive deeper into their key aspects, exploring their functions, the data they handle, the legal protections in place, and how consumers can proactively manage their credit information.

Exploring the Key Aspects of Consumer Reporting Agencies:

1. Definition and Core Concepts:

A consumer reporting agency (CRA) is a business that compiles and provides credit reports on individuals. These reports contain information about an individual's credit history, including payment history, outstanding debts, bankruptcies, and public records. The three major CRAs in the United States are Equifax, Experian, and TransUnion. While these are the most prominent, other agencies exist, specializing in niche areas or serving specific industries. The core function of a CRA is to collect and synthesize data from various sources, creating a standardized credit profile used by lenders and other businesses to assess risk. This assessment facilitates credit decisions, ensuring responsible lending practices and minimizing potential losses.

2. Data Collection and Reporting:

CRAs obtain information from a variety of sources, including:

- Credit grantors: Banks, credit card companies, and other lenders provide information on loan applications, payment histories, and outstanding balances.

- Public records: Court records, including bankruptcies, foreclosures, and judgments, are incorporated into credit reports.

- Collection agencies: Agencies reporting on unpaid debts contribute to the credit history.

- Other sources: Information may be gathered from utilities companies, landlords, and employers (though employment history is less common in consumer credit reports).

This information is then compiled into a credit report, typically including a credit score, which is a numerical representation of creditworthiness. The specific factors used to calculate a credit score vary depending on the scoring model used by the CRA. The credit report details the individual's credit history over a period of years, providing a comprehensive overview of their financial responsibility.

3. The Legal Framework (FCRA):

The Fair Credit Reporting Act (FCRA) is a federal law that regulates the collection, dissemination, and use of consumer credit information. It grants consumers significant rights, including:

- The right to obtain a copy of their credit report: Consumers can request a free credit report from each of the major CRAs annually at AnnualCreditReport.com. Beware of sites mimicking this official website—always go directly to the source.

- The right to dispute inaccurate information: Consumers can challenge any inaccurate or incomplete information contained in their credit report. CRAs are legally obligated to investigate and correct any errors.

- The right to know who has accessed their credit report: Consumers can request a list of entities that have accessed their credit report within the past year.

- The right to place a fraud alert or security freeze: These measures help protect against identity theft and unauthorized access to credit.

The FCRA also places restrictions on how CRAs can collect and use consumer data, ensuring responsible practices and protecting consumer privacy. Violations of the FCRA can result in significant penalties for CRAs and other entities.

4. Consumer Rights and Responsibilities:

Understanding your rights under the FCRA is paramount. Consumers should:

- Regularly review their credit reports: Identifying errors or suspicious activity early is crucial.

- Dispute any inaccurate information promptly: Follow the CRA’s dispute process carefully and document everything.

- Protect their personal information: Be vigilant against identity theft and take steps to safeguard sensitive data.

- Understand their credit score and how it's calculated: Knowing what factors impact your score allows for proactive improvement.

- Maintain a positive credit history: Consistent on-time payments are key to a strong credit profile.

Consumers also have responsibilities, such as providing accurate information to creditors and promptly reporting any suspected fraud or identity theft.

5. Dispute Resolution and Accuracy:

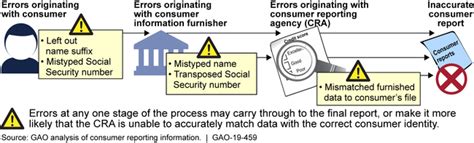

Disputing inaccurate information is a critical consumer right. The FCRA outlines a process for challenging inaccurate or incomplete data. Consumers should submit a dispute directly to the CRA and provide supporting documentation to prove the inaccuracy. The CRA is required to investigate the dispute and update the report if necessary. This process can take time, but persistence is important. If the dispute isn't resolved satisfactorily, consumers can escalate the issue to the Consumer Financial Protection Bureau (CFPB).

6. Impact on Financial Decisions:

Credit reports and scores significantly influence various financial decisions:

- Loan applications: Lenders use credit reports to assess the risk of lending money. A higher credit score typically results in lower interest rates and more favorable loan terms.

- Credit card applications: Similar to loans, credit card companies use credit reports to determine creditworthiness and set credit limits.

- Insurance premiums: Insurance companies may use credit information to assess risk and determine insurance premiums. A higher credit score may result in lower premiums.

- Employment: In some cases, employers may use credit reports to screen job applicants, though this practice is subject to regulations and restrictions.

- Rental applications: Landlords increasingly use credit reports to evaluate potential tenants.

Understanding the impact of your credit report on these decisions underscores the importance of maintaining a healthy credit profile.

Exploring the Connection Between Credit Scores and Consumer Reporting Agencies:

Credit scores are inextricably linked to consumer reporting agencies. CRAs don't directly create credit scores, but they provide the data used by scoring companies (like FICO and VantageScore) to calculate them. The credit score is a crucial element of the credit report, summarizing the information in a single numerical value that lenders readily understand. This connection emphasizes the importance of monitoring your credit report for accuracy and taking steps to improve your credit score, as it directly influences access to financial products and services.

Key Factors to Consider:

- Roles and Real-World Examples: CRAs collect information from various sources, generating comprehensive credit reports used by lenders to assess risk. For example, a missed credit card payment reported to a CRA could negatively impact a consumer's credit score, making it more difficult to secure a mortgage.

- Risks and Mitigations: Risks associated with CRAs include inaccurate information and identity theft. Mitigations include regularly checking credit reports, placing security freezes, and disputing errors promptly.

- Impact and Implications: The impact of CRAs is far-reaching, affecting access to credit, insurance, employment, and housing. Understanding your rights and responsibilities is crucial to navigating the system effectively.

Conclusion: Reinforcing the Connection:

The relationship between credit scores and consumer reporting agencies is fundamental to the functioning of the credit system. By addressing potential challenges and leveraging opportunities, consumers can use this knowledge to proactively manage their credit information and improve their financial well-being.

Further Analysis: Examining Credit Scores in Greater Detail:

Credit scores are derived from algorithms that weigh various factors differently. Understanding these factors—payment history, amounts owed, length of credit history, credit mix, and new credit—is crucial for improving one's score. Regular monitoring and responsible financial habits are essential to maintaining a strong credit profile.

FAQ Section: Answering Common Questions About Consumer Reporting Agencies:

- What is a consumer reporting agency? A consumer reporting agency (CRA) is a business that compiles and provides credit reports on individuals.

- How do CRAs collect information? CRAs collect information from credit grantors, public records, collection agencies, and other sources.

- What are my rights under the FCRA? The FCRA grants consumers the right to obtain their credit report, dispute inaccurate information, and place fraud alerts or security freezes.

- How can I improve my credit score? Paying bills on time, maintaining low credit utilization, and establishing a long credit history are key factors in improving your credit score.

- What should I do if I find an error on my credit report? Dispute the error with the CRA immediately, providing supporting documentation.

Practical Tips: Maximizing the Benefits of Understanding CRAs:

- Request your free annual credit reports: Obtain a copy from each of the three major CRAs at AnnualCreditReport.com.

- Review your reports carefully: Check for any inaccuracies or suspicious activity.

- Dispute any errors promptly: Follow the CRA's dispute process and keep records.

- Monitor your credit score: Track your score over time to identify any potential issues.

- Practice responsible credit management: Pay bills on time and maintain a low debt-to-credit ratio.

Final Conclusion: Wrapping Up with Lasting Insights:

Consumer reporting agencies play a critical role in the financial system, influencing numerous aspects of individual financial lives. By understanding their functions, the data they collect, and the legal framework that governs them, consumers can take proactive steps to protect their credit information, maintain a positive credit profile, and navigate the complexities of the credit system effectively. Proactive engagement and responsible financial habits are key to securing a strong financial future.

Latest Posts

Related Post

Thank you for visiting our website which covers about Consumer Reporting Agency Definition . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.