Best App For Money Management Uk

adminse

Apr 06, 2025 · 7 min read

Table of Contents

Finding the Best Money Management App for You in the UK: A Comprehensive Guide

What if effortlessly managing your finances could unlock a brighter financial future? The right money management app can transform how you handle your money, paving the way for improved savings, reduced debt, and greater financial clarity.

Editor’s Note: This article on the best money management apps for the UK was published today, offering up-to-date information and insights to help you navigate the diverse options available.

Why a UK Money Management App Matters:

Navigating personal finances in the UK can be complex, with various tax implications, banking systems, and financial products. A well-designed money management app simplifies this complexity, providing a centralised view of your financial landscape. From tracking spending and budgeting to setting savings goals and managing investments, these apps offer invaluable tools for individuals and families aiming for improved financial health. The best apps cater specifically to the UK market, integrating with local banks, recognising relevant tax rules, and offering features tailored to the British financial environment.

Overview: What This Article Covers:

This article provides a comprehensive exploration of the best money management apps available in the UK. We will delve into their key features, benefits, pricing structures, and target users. We will also analyze crucial factors to consider when selecting an app, helping you make an informed decision based on your individual needs and financial goals.

The Research and Effort Behind the Insights:

This guide is the result of extensive research, comparing numerous apps based on user reviews, expert opinions, and feature analysis. We considered factors like security, ease of use, integration with UK banking systems, and the range of features offered. The aim is to provide you with unbiased, evidence-based information to empower your choice.

Key Takeaways:

- Definition and Core Concepts: Understanding the core functionalities of money management apps, including budgeting, expense tracking, and financial forecasting.

- App Features Comparison: A detailed comparison of leading UK money management apps, highlighting their strengths and weaknesses.

- Selecting the Right App: A structured approach to choosing the best app based on individual needs and financial goals.

- Security and Privacy: Essential considerations regarding the security and privacy of your financial data.

- Future Trends: Exploring future developments in the UK money management app landscape.

Smooth Transition to the Core Discussion:

Now that we understand the importance of choosing the right money management app, let's explore the key aspects to consider when making your selection.

Exploring the Key Aspects of Choosing a UK Money Management App:

1. Definition and Core Concepts:

A UK money management app typically offers a range of features designed to help users track their income and expenses, create budgets, set financial goals, and monitor their overall financial health. Many integrate directly with UK bank accounts and credit cards, automatically importing transaction data to eliminate manual entry. Advanced features may include investment tracking, debt management tools, and financial planning features.

2. App Features Comparison:

The UK market offers a diverse range of apps, each with its own strengths and weaknesses. Some popular options include:

- Monzo: While primarily a mobile bank, Monzo offers excellent budgeting and spending tracking tools directly within its app. Its intuitive interface and vibrant community make it a popular choice, especially among younger users.

- Revolut: Similar to Monzo, Revolut is a challenger bank with strong money management features. It excels in international spending and currency exchange, making it suitable for frequent travellers.

- Plum: This app uses AI to automatically save small amounts of money from your account, making saving effortless. It’s ideal for those who want to save regularly without actively managing a budget.

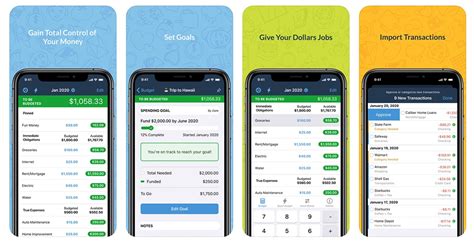

- YNAB (You Need A Budget): YNAB is a popular budgeting app known for its zero-based budgeting method. It requires a subscription, but its powerful features and dedicated community make it a favourite among those seeking comprehensive budget control.

- Money Dashboard: This app provides a consolidated view of your finances, pulling data from multiple accounts (including mortgages and loans) into a single dashboard. It's a good choice for users with complex financial situations.

- Chase: Offers excellent features including budgeting and spending tracking, but currently limited to users who can apply through an invitation process.

- Starling Bank: Another challenger bank offering excellent budgeting and spending management tools directly within its app. Similar to Monzo, it has a strong focus on user experience.

This is not an exhaustive list, and the best app for you will depend on your specific needs and preferences.

3. Challenges and Solutions:

Choosing a money management app presents some challenges:

- Data Security: Ensuring the app provider has robust security measures in place to protect your sensitive financial information. Look for apps with encryption and two-factor authentication.

- Integration Issues: Some apps may not integrate seamlessly with all UK banks, leading to manual data entry or incomplete data.

- Subscription Costs: While many apps offer free versions, advanced features often require a paid subscription. Consider whether the premium features justify the cost.

- Complexity: Some apps can be overly complex for users with simpler financial needs.

4. Impact on Innovation:

Money management apps are constantly evolving, incorporating new technologies and features to improve user experience and financial management capabilities. The integration of AI and machine learning is particularly noteworthy, with apps now offering features like personalized financial advice and predictive budgeting.

Exploring the Connection Between Budgeting and Money Management Apps:

Budgeting is a cornerstone of effective money management, and many apps excel in this area. The relationship between budgeting and money management apps is symbiotic. Apps provide the tools to create and track budgets, while budgeting itself is the foundation for responsible financial behaviour.

Key Factors to Consider:

- Roles and Real-World Examples: YNAB, for instance, guides users through a zero-based budgeting process, ensuring all income is allocated to specific categories. This eliminates overspending and promotes conscious spending habits.

- Risks and Mitigations: Incorrectly setting up a budget or failing to track expenses accurately can lead to inaccurate financial projections. Regularly reviewing and adjusting the budget is crucial.

- Impact and Implications: Effective budgeting, facilitated by a money management app, leads to improved savings, reduced debt, and greater financial control.

Conclusion: Reinforcing the Connection:

The connection between budgeting and money management apps is clear. Apps provide the technology, while effective budgeting provides the strategy. By combining both, users gain a powerful tool for achieving their financial goals.

Further Analysis: Examining Budgeting Strategies in Greater Detail:

Several budgeting strategies work well with money management apps. The 50/30/20 rule (50% needs, 30% wants, 20% savings & debt repayment) is a popular and simple approach. Zero-based budgeting, as used by YNAB, offers a more granular approach, allocating every pound of income. Choosing the right strategy depends on individual circumstances and financial goals.

FAQ Section: Answering Common Questions About UK Money Management Apps:

-

Q: What is the best money management app for beginners?

- A: Monzo or Starling Bank are good starting points due to their intuitive interfaces and ease of use.

-

Q: Are my financial data safe with these apps?

- A: Reputable apps employ robust security measures, including encryption and two-factor authentication. However, it's crucial to choose well-established apps with a strong security reputation.

-

Q: How do I choose an app that integrates with my bank?

- A: Most apps list compatible banks on their websites or within the app itself. Check compatibility before signing up.

-

Q: Are there free money management apps?

- A: Yes, many apps offer free basic functionality, but advanced features often require a subscription.

Practical Tips: Maximizing the Benefits of Money Management Apps:

- Choose the Right App: Consider your financial needs, tech-savviness, and budget when choosing an app.

- Accurate Data Entry: Ensure all transactions are accurately recorded to avoid inaccurate financial summaries.

- Regular Monitoring: Regularly review your budget and spending patterns to identify areas for improvement.

- Set Realistic Goals: Set achievable financial goals to maintain motivation and track progress.

- Utilize App Features: Explore all features offered by your chosen app to unlock its full potential.

Final Conclusion: Wrapping Up with Lasting Insights:

Choosing the right money management app can significantly impact your financial well-being. By understanding your needs, researching available options, and effectively utilizing the chosen app's features, you can take control of your finances, improve your savings, and build a secure financial future. The apps discussed here offer a range of options, catering to various financial needs and tech proficiency levels. Remember to prioritize security, ease of use, and features that align with your personal financial objectives. The journey to improved financial health begins with a single step – selecting the right money management app.

Latest Posts

Latest Posts

-

Can I Get A New Credit Card With The Same Number

Apr 08, 2025

-

Can I Get A New Credit Card At The Bank

Apr 08, 2025

-

When Should I Open A New Credit Card

Apr 08, 2025

-

Do I Get A New Credit Card When It Expires

Apr 08, 2025

-

Should I Get A New Credit Card Or Increase Limit

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about Best App For Money Management Uk . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.